Estate Administration Lawyer Scranton, PA

A Scranton, PA estate administration lawyer knows that over the years, the dynamic of families is much different than it was decades ago. Today, especially with the high rate of divorce and remarriage, families are often blended – made up of biological children and stepchildren. At Hoegen & Associates, P.C., we have experience working with all kinds of families in coming with the best estate plan for each family’s circumstances.

Studies on Blended Families and Wills

Multiple studies have been conducted on blended families and estate planning. One major study was conducted by the National Bureau of Economic Research, examining just how parents are dividing up their estates when they have biological children and stepchildren and how these relationships affect the amount of those inheritances.

Although one may think that having stepchildren would result in an unequal bequest to their non-biological children, the study showed that it was only a factor in about 30 percent of parents surveyed. The majority of survey participants reported that their stepchildren received equal – or in some cases – even additional assets over their biological children.

There were also parents surveyed that did not have stepchildren but reported uneven asset distribution among their biological children. The rate of this occurring almost doubled if the parents had not had contact with their children for more than a year. Adult children who stayed close to their parents were more likely to inherit more than children who stayed away.

This bonding time also applied to stepchildren. If parents spent more bonding time with their stepchildren that had been in their lives for at least a decade than their biological children, that stepchild is more likely to be included in the parent’s will.

Alarming Statistic

One troubling statistic that emerged from this survey was that two out of every five participants admitted they did not have a will drafted. Even though failure to have a will could affect their stepchildren’s entitlement to inherit anything from the parent’s estate, the most common reason giving for this lack of a will was their unease at contemplating their own death. Current law does not make provisions for any children other than biological children’s rights to their parent’s estate if the parent failed to have a will specifying their wishes.

Another important factor, especially if your children and stepchildren are minors, is that a will is also where parents name who they wish to be named as their child’s legal guardian should something happen to them. Should something happen to you and your spouse, if you don’t have a legal guardian named, the court will do it and the person they choose may not be the same person you would have chosen.

Contact an Estate Lawyer for More Information

You are never too young to make a will. All parents, whether your child is biological, adopted, or a stepchild should consider meeting with a skilled Scranton, PA estate administration lawyer to find out what type of estate planning options you may have. If you would like to learn more, call Hoegen & Associates, P.C. to schedule a free consultation.

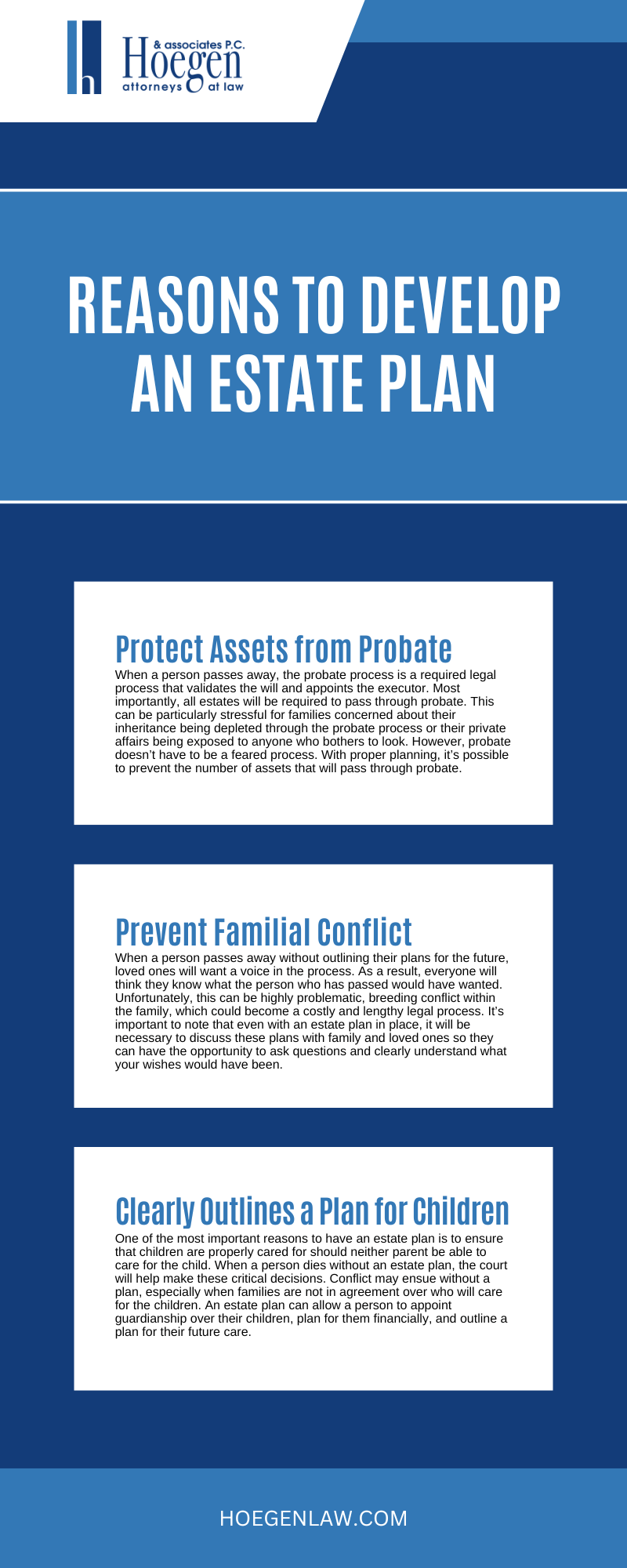

Reasons To Develop An Estate Plan

A Scranton estate planning lawyer holds the tools necessary to ensure that a concrete and well-thought-out estate plan is developed. Because of this, it’s crucial for those who don’t have a plan in place to strategically develop a plan for the future. Estate planning with an experienced professional can ensure that their plans for the future are protected and carried out in the way that they were intended. An estate plan is far more advantageous than many realize and far more comprehensive than a will. A last will and testament is merely one tool available for those developing a plan. With a lawyer, it’s possible to create a plan that allows the testator to define their wishes for the future clearly. The following are common reasons Hoegen & Associates, P.C. shares that an estate plan should be considered:

#1. Protect Assets from Probate

When a person passes away, the probate process is a required legal process that validates the will and appoints the executor. Most importantly, all estates will be required to pass through probate. This can be particularly stressful for families concerned about their inheritance being depleted through the probate process or their private affairs being exposed to anyone who bothers to look. However, probate doesn’t have to be a feared process. With proper planning, it’s possible to prevent the number of assets that will pass through probate.

#2. Prevent Familial Conflict

When a person passes away without outlining their plans for the future, loved ones will want a voice in the process. As a result, everyone will think they know what the person who has passed would have wanted. Unfortunately, this can be highly problematic, breeding conflict within the family, which could become a costly and lengthy legal process. It’s important to note that even with an estate plan in place, it will be necessary to discuss these plans with family and loved ones so they can have the opportunity to ask questions and clearly understand what your wishes would have been.

#3. Clearly Outlines a Plan for Children

One of the most important reasons to have an estate plan is to ensure that children are properly cared for should neither parent be able to care for the child. When a person dies without an estate plan, the court will help make these critical decisions. Conflict may ensue without a plan, especially when families are not in agreement over who will care for the children. An estate plan can allow a person to appoint guardianship over their children, plan for them financially, and outline a plan for their future care.

The Role of the Estate Administrator

When a person develops their estate plan, one of the most critical decisions that must be made is to appoint someone to oversee their estate and carry their wishes out accordingly. An estate administrator or executor is legally appointed to resolve the estate, pay debts and taxes, and distribute assets to beneficiaries. It’s essential to be aware that this is not a role that should be taken lightly. When a person is developing their estate plan, they should take the time to appoint someone they trust carefully but who is up for taking on this significant responsibility.

While developing a plan for the future can seem like a hefty one, one to put off for another day, this is not recommended. By taking the time to outline future wishes, a person can ensure that they have planned for a time when they can no longer make decisions on their own. To learn more about the services offered by our Scranton estate planning lawyer from Hoegen & Associates, P.C., schedule a consultation as soon as possible.

Scranton Estate Administration Infographic

Frequently Asked Questions About The Process Of Drafting A Will

Planning your estate can feel overwhelming, but creating a will is one of the most important steps you can take to protect your loved ones and ensure your wishes are followed. A well-drafted will allows you to decide how your assets will be distributed, appoint guardians for minor children, and establish other important instructions. Working with a Scranton, PA estate administration lawyer can make this process more straightforward and help avoid potential legal issues.

What Is Probate And How Does It Affect My Will?

Probate is the legal process of proving and validating a will after someone has passed away. It involves the court overseeing the distribution of assets and settling any debts. If you have a valid will, probate typically ensures your wishes are carried out as written. However, probate can take time, and some assets may be tied up until the process is complete. Having a well-structured will can make probate smoother, reducing potential delays or disputes.

How Do I Create A Living Trust?

A living trust is a separate legal document that can be used in addition to a will. Unlike a will, a living trust takes effect during your lifetime and allows you to transfer ownership of your assets into the trust. You continue to manage those assets while you’re alive, and after your death, the trust transfers them to your beneficiaries without going through probate. To create a living trust, you would need to name a trustee, detail how your assets should be handled, and transfer ownership of the assets to the trust. Our Scranton estate administration lawyer will share that this option can provide more control over your assets and bypass the probate process entirely.

Can I Appoint A Financial Power Of Attorney In My Will?

A financial power of attorney cannot be appointed in a will, as it is a separate legal document. The financial power of attorney allows you to designate someone to make financial decisions on your behalf while you are still alive but incapacitated. A will, on the other hand, only goes into effect after your passing. It’s important to have both documents in place, as they serve different purposes. Including a financial power of attorney as part of your overall estate plan is a good way to ensure your finances are handled according to your wishes if you are unable to do so.

What Is The Difference Between A Will And A Living Will?

A will and a living will serve distinct functions. A will outlines how you want your assets distributed and may also address guardianship and other final wishes. It goes into effect after death. A living will, however, is a document that expresses your wishes regarding medical treatment if you become unable to communicate or make decisions. It’s typically used in situations where end-of-life care or medical interventions are involved. Having both a will and a living will ensures that your financial and medical decisions are clearly documented and respected.

How Long Does It Take For A Will To Go Through Probate?

The time it takes for a will to go through probate can vary depending on several factors, such as the complexity of the estate, whether the will is contested, and the court’s schedule. On average, the probate process can take anywhere from a few months to over a year. A clear and properly executed will may help speed up the process, but if any disputes arise or there are complications in distributing the assets, probate may take longer. It’s important to discuss these potential timelines with a legal professional to better understand what to expect.

Getting Help With Your Estate Planning

Drafting a will is an essential part of estate planning, and having the right guidance can make the process smoother. Since 1971, Hoegen & Associates, P.C., has assisted clients with their estate planning needs. If you’re looking for advice or want to get started with a Scranton estate administration lawyer, contact us today. We’re ready to help you create a plan that provides peace of mind and security for your loved ones by offering you a complimentary consultation.

Estate Administration Law Glossary

When working with a Scranton, PA estate administration lawyer, it’s important to understand key legal terms that often come up in the estate planning and administration process. Whether you’re planning your own estate or managing a loved one’s, having a clear grasp of the following terms will help you feel more confident and informed as you move forward.

Executor Of The Estate

An executor is the person legally appointed to manage and distribute a deceased person’s estate. Their primary duties include filing the will with the probate court, settling debts, paying taxes, and ensuring assets are distributed according to the terms of the will. In Scranton, PA estate administration cases, the executor must act in good faith and is held accountable by the court for each step taken in the process. If no executor is named in the will, or if the named individual cannot serve, the court appoints an administrator to carry out the responsibilities.

This role is more than symbolic—it involves close coordination with attorneys, courts, and beneficiaries. Executors must keep detailed records of all financial activities related to the estate. Choosing someone trustworthy and capable of handling financial and legal matters is critical when creating an estate plan.

Living Trust

A living trust is a legal arrangement that allows individuals to transfer ownership of assets into a trust during their lifetime. This document names a trustee—often the individual creating the trust or someone they designate—to manage and eventually distribute the assets to beneficiaries after their death. The key advantage is that assets in a living trust generally bypass probate, resulting in faster distribution and greater privacy.

For clients working with an estate administration lawyer in Scranton, PA, a living trust is a useful option when they wish to maintain control over their estate while avoiding the delays and costs associated with probate. Unlike a will, a living trust becomes effective as soon as it’s executed and funded.

Guardian Appointment

A guardian is someone appointed to care for minor children or incapacitated individuals in the event their parents or caregivers pass away or are unable to fulfill their responsibilities. This appointment is typically made within a last will and testament. In Pennsylvania, if no guardian is named and the parents pass away, the court will decide who takes custody of the children, which may not align with the family’s preferences.

Scranton, PA estate administration lawyers frequently emphasize the importance of formally appointing a guardian as part of an estate plan. This helps to avoid legal disputes among surviving relatives and provides children with a smoother transition during a difficult time.

Probate Process

Probate is the legal process of proving the validity of a will, settling debts, and distributing the remaining assets to beneficiaries. It begins when the executor files the will with the probate court. All estates in Pennsylvania must pass through probate unless the assets are placed in a trust or jointly held with rights of survivorship.

The length and complexity of probate vary depending on the size of the estate, whether there are disputes among heirs, and if creditors make claims. In Scranton, PA, estate administration lawyers can guide clients through this process, helping minimize delays and unnecessary legal expenses. Planning ahead can reduce the portion of the estate subject to probate and keep more assets in the hands of heirs.

Intestate Succession

When a person dies without a valid will, they are said to have died “intestate.” In these cases, the estate is distributed based on Pennsylvania’s intestate succession laws. These laws prioritize spouses, children, and close relatives, regardless of the deceased’s actual wishes.

This default process can lead to outcomes that might not reflect the individual’s intentions—particularly in blended families or when estranged relatives are involved. A Scranton, PA estate administration lawyer can help draft a will or trust to prevent intestacy, ensuring that one’s wishes are legally documented and followed.

Creating a well-structured estate plan helps bring clarity, avoids court-imposed decisions, and supports your family’s long-term stability. At Hoegen & Associates, P.C., we guide individuals and families in Scranton, PA through every step of the estate planning and administration process with practical, effective legal strategies.

To take the next step in protecting your legacy, contact our office to schedule a consultation with a Scranton, PA estate administration lawyer. We’re ready to help you develop a plan that reflects your goals and values.