Estate Lawyer Scranton, PA

At Hoegen & Associates, P.C., we understand that estate planning is a personal and essential step in securing your family’s future. Our experienced team of estate lawyers in Scranton is here to guide you through the process with compassion and expertise, ensuring that your assets are protected and your wishes are honored.

Why Choose Hoegen & Associates, P.C. for Your Estate Planning Needs?

Estate planning is more than just drafting a will. It involves a comprehensive strategy to manage your assets during your lifetime and after your passing. At Hoegen & Associates, P.C., we offer personalized estate planning services tailored to your unique needs. Our team is committed to providing clarity, peace of mind, and the highest level of service.

Our Comprehensive Estate Planning Services

1. Wills and Trusts

Creating a will or trust is a critical part of any estate plan. We assist clients in drafting wills that clearly articulate their wishes and establish trusts to provide for their loved ones, minimize estate taxes, and avoid probate.

2. Powers of Attorney

We help clients prepare durable powers of attorney, which allow a trusted person to make financial and legal decisions on their behalf should they become incapacitated.

3. Healthcare Directives and Living Wills

Planning for medical emergencies is vital. We assist in creating healthcare directives and living wills that specify your preferences for medical care, ensuring your wishes are followed even if you are unable to communicate them.

4. Estate and Gift Tax Planning

Our lawyers are experienced in developing strategies to minimize estate and gift taxes, helping you preserve more of your wealth for your heirs.

5. Guardianship Designations

Designating a guardian for minor children or dependents is an essential part of the estate planning process. We help clients choose and legally designate guardians to ensure their loved ones are cared for by the right person.

6. Business Succession Planning

For business owners, planning for the future involves more than personal estate planning. Our team provides comprehensive business succession planning services to ensure the smooth transition of your business to the next generation or new owners.

Tailored Solutions for Every Client

At Hoegen & Associates, P.C., we believe in providing tailored estate planning solutions that reflect each client’s unique circumstances and goals. Whether you have a simple estate or complex assets, we will work with you to develop a plan that meets your needs.

Common Estate Planning Misconceptions

- “I’m too young to need estate planning.”

Estate planning is not just for the elderly or wealthy. Anyone with assets, dependents, or specific wishes for their medical care should consider estate planning. - “A simple will is all I need.”

While a will is a critical component of an estate plan, it may not cover all aspects of your estate. Trusts, powers of attorney, and healthcare directives are equally important.

A Scranton, PA estate lawyer knows how critical digital assets are in today’s society, however, these assets can be disastrous for families and estate executors. Digital assets such as email accounts, online banking accounts, phone apps, photos stored in cloud accounts, digital music accounts, and more make our lives easier when we are alive but have historically caused all kinds of issues when the account holder dies. At Hoegen & Associates, P.C., we are aware of many cases where loved ones have forgotten about or failed to consider how important it was to grant access to their digital account via their estate plan and their executors were left with no way to gain access. Our estate lawyers have also heard of cases where access was permitted, but the account owners failed to keep their information updated or the accounts automatically closed upon their death, all denying access to executors.

When this happened, the problems created were many – final bills of the estate going unpaid, family photos lost forever because cloud accounts could not be accessed, and more. Luckily, the state of Pennsylvania has taken the steps to prevent these situations and provides provisions for families and executors to close out estates with digital assets.

Uniform Law Commission, Act 72

In Pennsylvania, under the provisions of Act 72 from the Uniform Law Commission, fiduciaries are granted the legal authority to manage and access the digital assets of individuals who have either passed away or become incapacitated. This authority extends to the executors of estates.

A Scranton-based estate attorney would explain that an executor, typically nominated by the decedent in their will, is responsible for the comprehensive management and closure of the decedent’s estate. This role involves several critical tasks, including settling final expenses, notifying potential beneficiaries, acquiring death certificates, selling properties that are not designated for distribution, and resolving all other relevant affairs related to the decedent’s estate.

While at first, managing digital accounts might not appear essential for these duties, it often becomes crucial due to several online-related issues that may arise. For instance, the executor may be required to:

- Make online payments for any bills left by the decedent.

- Retrieve contact information like phone numbers and addresses from online accounts.

- Conduct administrative modifications to blogs or social media profiles owned by the decedent.

- Cancel subscriptions that are accessible exclusively online, to prevent ongoing charges.

- Manage or pay insurance premiums through online platforms.

- Access digital storage services to download, print, or transfer important photographs and documents.

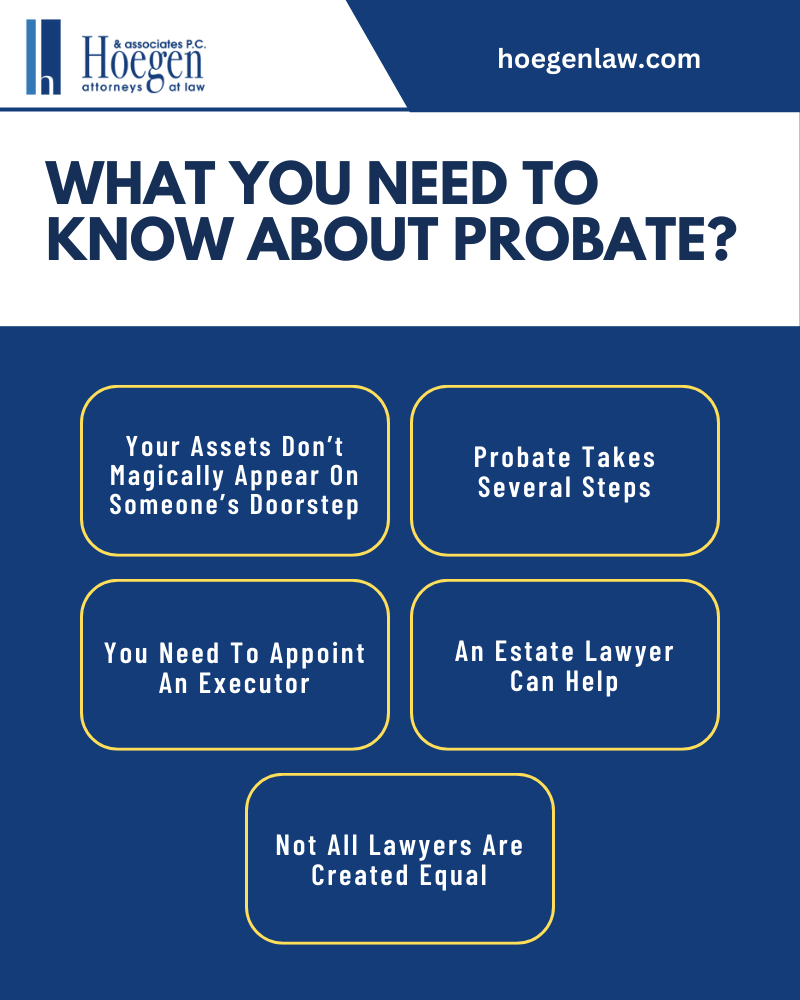

What You Need To Know About Probate

In Scranton, PA, estate planning is a critical aspect of preparing for the future, and attorneys at Hoegen & Associates, P.C. specialize in making this process smoother for you and your loved ones. This detailed guide delves into the intricacies of probate, emphasizing the importance of professional legal guidance.

Your Legacy and Assets

Creating a will is a responsible step in legacy planning. It involves listing your assets, which can range from real estate to personal collections and investments, and designating beneficiaries who will inherit these assets. However, the transfer of these assets to your beneficiaries isn’t automatic or instantaneous upon your death.

The Complexities of Probate

Probate is a legally mandated process that ensures the proper distribution of your assets as per your will. This process starts with notifying beneficiaries about the death and concludes when they receive their inheritance. However, between these points lies a complex procedure involving asset identification, valuation by professionals, legal notifications, and various fees. A qualified Scranton estate lawyer can significantly simplify this process.

Choosing an Executor

A crucial part of estate planning involves appointing an executor – a trusted individual, often a friend or family member, designated to execute the directives in your will. Without a named executor, the state may appoint one, which may not align with your best interests. The appointed executor may be a family member, but there’s no assurance they will prioritize your wishes.

The Role of an Estate Lawyer

Estate lawyers play a pivotal role in estate planning. They assist in selecting an appropriate executor, comprehensively reviewing assets, identifying beneficiaries, and drafting a will. Seeking legal advice before creating a will ensures that your estate plan is robust and reflective of your intentions.

Choosing the Right Lawyer

Not every lawyer offers the same level of expertise or commitment. Some may prioritize financial gain over client needs, while others may lack the necessary experience. Hoegen & Associates, P.C., however, stands out by offering free consultations and dedicated case management. Their lawyers are committed to ensuring your future and that of your loved ones is secure, offering comprehensive support throughout the estate planning process.

This guide underscores the need for professional legal assistance in navigating the complexities of probate and estate planning, emphasizing the value of selecting a knowledgeable and trustworthy estate lawyer.

Scranton Estate Infographic

Understanding the Different Types of Estate Planning

Estate planning can be a daunting task, but it is essential to ensure that your assets are managed and distributed according to your wishes with the help of a Scranton, PA estate lawyer by your side. It is a process that involves careful consideration, reflection, and consultation with professionals that can guide you in making the right decisions. One of the most significant parts of creating an estate plan is to understand the different types of planning options available, contact Hoegen & Associates, P.C. for help.

Wills

A will is a legal document that outlines the distribution of your assets once you pass. It is a crucial foundation for any estate plan and ensures that your wishes are carried out when you die. When creating a will, a lawyer can help you assess your assets, decide on beneficiaries, and outline any specific conditions related to the distribution of your assets. This is the most common type of planning you may already know about.

Benefits of a Will

- Simplicity and Cost: Creating a Will is generally simpler and less expensive than setting up a Trust. This simplicity can be attractive to individuals with smaller estates or those who prefer not to engage in the more complex planning required for a Trust.

- Naming Guardians for Children: A Will is the legal instrument used to appoint guardians for minor children. This capability is crucial for parents who wish to ensure that their children are cared for by the person they trust in the event of their untimely death.

- Flexibility to Change or Revoke: Wills can be easily altered or revoked during the lifetime of the testator (the person who makes the Will), as long as they are mentally competent. This flexibility allows for adjustments as circumstances change, such as new family members, divorces, or changes in financial status.

- Clear Direction Upon Death: A Will provides clear instructions on how the assets should be distributed after death. It serves as a comprehensive statement of the testator’s final wishes regarding their estate, minimizing potential disputes among survivors.

Trusts

Unlike a will, a trust is a legally enforceable entity that holds assets for beneficiaries. Trusts have become increasingly popular because it eliminates the need for probate, where court supervision is required for the transfer of assets. Choosing to create a trust can help to protect your assets and ensure that your beneficiaries receive the financial support they need. Trusts can also protect your money so that beneficiaries do not use the money before they are supposed to.

Benefits of a Trust

- Avoiding Probate: One of the most significant benefits of a Trust is that it allows the estate to bypass the probate process, which can be time-consuming and expensive. Since the assets placed in a Trust are technically no longer part of the estate at the owner’s death, they can be distributed directly to beneficiaries without court intervention.

- Privacy: Unlike a Will, which becomes a public document once it enters the probate process, a Trust remains private. This confidentiality can be crucial for individuals who wish to keep the details of their estate and their beneficiaries private.

- Control Over Assets: Trusts provide the grantor (the person who creates the Trust) extensive control over how their assets are managed and distributed. For example, a Trust can specify that the beneficiaries receive their inheritance at certain ages or upon meeting specific conditions, such as graduating from college.

- Protection from Legal Challenges: Trusts are generally harder to contest than Wills. This characteristic can be especially important in situations where the grantor anticipates that disgruntled heirs might challenge the estate plan.

- Flexibility: Trusts can be structured in many ways to address specific needs, such as special needs Trusts designed to provide for a beneficiary with disabilities without jeopardizing their eligibility for government benefits.

- Management During Incapacity: A Trust can be set up to manage the grantor’s assets if they become incapacitated. This arrangement can ensure that the grantor’s financial affairs are handled according to their wishes without the need for court-appointed guardianship.

Power of Attorney

According to a Scranton estate lawyer, power of attorney is a legal document that grants someone else the power to make decisions on your behalf. It is beneficial in the event that you are unable to make decisions due to health or other circumstances. You can appoint someone to handle your medical and financial affairs, which provides an added layer of security.

Advance Directives

Advance directives are legal documents that outline your healthcare wishes. These directives can include items such as a living will, which outlines the medical treatment that you wish to receive, and a healthcare proxy document, which appoints someone to make healthcare decisions on your behalf.

Special Needs Trusts

Special needs trusts are utilized for beneficiaries who have disabilities or other medical conditions. These trusts manage assets to provide support for their care without jeopardizing their eligibility for government benefits.

Planning for your estate can be a complex process, but it is essential for ensuring that your wishes are met after death. Understanding the different types of estate planning options and how they work can help you make informed decisions about your financial future. With the guidance of an experienced estate planning attorney, you can create a comprehensive plan that addresses your individual needs and goals. Don’t delay in starting your estate planning journey, as early planning can help protect your assets and ensure the financial stability of your beneficiaries. Contact a Scranton estate lawyer at Hoegen & Associates, P.C. today.

Scranton Estate Lawyer FAQs

A Scranton, PA estate lawyer will work closely with you in making the important decisions for the distribution of assets, minimizing taxes, and protecting the interests of beneficiaries. We’ve compiled a few questions below that further outline the specialized benefits of working with an experienced Scranton estate lawyer.

Why should I hire an estate lawyer?

Estate lawyers are legal professionals with expertise in estate planning, probate, and related matters. They possess in-depth knowledge of state and federal laws governing estate planning, tax implications, and asset distribution. By hiring an estate lawyer, you gain access to their specialized knowledge and experience, ensuring your estate plan is tailored to your unique circumstances. They can provide personalized advice, help you navigate complex legal processes, and assist in minimizing potential disputes among beneficiaries.

What are the benefits of estate planning?

Estate planning offers numerous benefits, including:

- Control over asset distribution: With a well-crafted estate plan, you can dictate how your assets will be distributed among your loved ones, charitable organizations, or other beneficiaries. This provides peace of mind and helps avoid potential conflicts or uncertainties.

- Minimization of estate taxes: An estate lawyer can guide you in implementing strategies to minimize estate taxes, potentially saving your beneficiaries significant amounts of money.

- Protection of beneficiaries: Through trust arrangements and other mechanisms, an estate plan can safeguard the interests of vulnerable beneficiaries, such as minor children or individuals with special needs, ensuring their financial security and well-being.

- Avoidance of probate: Proper estate planning can help streamline the probate process or even bypass it altogether. This saves time, reduces costs, and maintains privacy for your family.

When should I start estate planning?

Estate planning is not restricted to a specific age or financial status. Ideally, you should start estate planning as soon as you have assets or dependents that you wish to protect. Life events such as marriage, the birth of a child, or acquiring significant assets should trigger a review of your estate plan. It’s essential to consult with an estate lawyer early to create a comprehensive plan that can be adjusted as your circumstances change over time.

What documents are essential for estate planning?

Estate planning typically involves the following essential documents:

- a) Will: A will outlines how your assets will be distributed upon your death and allows you to name guardians for minor children.

- b) Trust: Trusts provide greater flexibility and control over the distribution of assets, privacy, and potential tax benefits. They can be established during your lifetime (living trust) or as part of your will (testamentary trust).

- c) Power of Attorney: This document designates someone to handle your financial and legal affairs in case of incapacity.

- d) Advance Healthcare Directive: Also known as a living will, this document outlines your medical treatment preferences and designates a healthcare proxy to make decisions on your behalf if you are unable to do so.

Can I create an estate plan without a lawyer?

While it is technically possible to create a basic estate plan without a lawyer, it carries significant risks. Estate planning involves complex legal issues and intricacies that require professional expertise to ensure your wishes are effectively executed. DIY approaches may lead to errors, omissions, or inconsistencies that can render your estate plan invalid or subject to legal challenges. Engaging with an estate lawyer provides the knowledge, experience, and guidance necessary to create a legally sound and comprehensive estate plan.

Don’t hesitate to contact our offices today for skilled guidance. We offer a plethora of estate planning services and will work tirelessly on your behalf to ensure you have a secure financial future when you contact a Scranton estate lawyer today!

Estate Glossary

When working with a Scranton, PA Estate Lawyer, understanding key legal terms can help make the estate process clearer and more manageable. Whether you’re managing a loved one’s estate or preparing your own affairs, knowing what these terms mean can help guide the legal decisions you’ll face. Below are five important phrases we often address in our estate planning and probate work.

Probate Administration

Probate administration refers to the legal process of managing and distributing a deceased person’s estate under court supervision. This includes validating the will, identifying assets, paying debts and taxes, and distributing remaining assets to beneficiaries. If no will exists, the estate is handled under Pennsylvania’s intestacy laws, which determine who inherits based on familial relationships. For those named as executors, the probate process can be complex and time-consuming, especially when disputes arise or assets are difficult to locate.

Letters Testamentary

Letters testamentary are legal documents issued by the county Register of Wills that authorize the executor named in a decedent’s will to act on behalf of the estate. This document provides the executor the authority to access financial accounts, transfer property, and carry out other tasks necessary to settle the estate. Without this court-issued authorization, banks and institutions typically will not allow access to the deceased’s assets. If there is no will, a similar document called “letters of administration” is issued to an appointed administrator.

Intestate Succession

Intestate succession occurs when someone dies without a valid will. In this case, the Pennsylvania laws of intestacy dictate who receives the estate. The order of inheritance typically begins with a spouse and children, followed by parents, siblings, and more distant relatives. The probate court oversees the appointment of an administrator to manage the estate. Intestate succession can lead to unexpected outcomes for surviving family members, especially in blended families or situations with estranged relatives.

Fiduciary Duty

Fiduciary duty is the legal obligation of someone acting in a position of trust—such as an executor, trustee, or agent under a power of attorney—to act in the best interests of another person. In estate matters, executors and trustees must handle assets responsibly, avoid conflicts of interest, and follow the directions outlined in the will or trust. Breaching fiduciary duty, such as self-dealing or mismanagement, can result in legal consequences, including personal liability. This duty is central to every estate or trust administration case we handle.

Revocable Living Trust

A revocable living trust is a legal arrangement that allows a person (the grantor) to transfer ownership of assets into a trust while still retaining control during their lifetime. This type of trust can be amended or revoked at any time before the grantor’s death. Upon death, assets held in the trust pass to beneficiaries without going through probate. These trusts are commonly used to maintain privacy and streamline estate administration. However, they must be properly funded to be effective; simply creating the trust is not enough.

If you’re unsure how these legal terms apply to your specific situation, working with a dedicated estate planning attorney can help bring clarity and direction. At Hickey & Turim, S.C., we’re here to help clients in Scranton and the surrounding areas handle the full range of estate matters with confidence and care.

Let’s talk about how we can help you move forward with your estate planning or administration. Call us today to schedule a consultation.

Schedule Your Consultation Today

Estate planning is an essential process that not only secures your financial legacy but also ensures peace of mind for both you and your loved ones. It involves careful consideration of various elements, such as asset distribution, appointing an executor, and understanding the nuances of probate. The complexities of these tasks cannot be understated, making the assistance of a knowledgeable estate lawyer invaluable. Hoegen & Associates, P.C., with their expertise in estate law and commitment to client-centered service, stands as a beacon of trust and proficiency in this field. Their approach to estate planning is comprehensive, ensuring that every aspect of your legacy is addressed with the utmost care and professionalism.

We understand the importance of protecting your legacy and ensuring your family’s financial security. Our dedicated estate planning attorneys in Scranton are here to provide guidance, support, and expertise at every step. Contact Hoegen & Associates, P.C. today to schedule a consultation and start planning for your future with confidence.